Filling out a W-4 form can be confusing. The W-4 form is an IRS document that helps your employer decide how much of your paycheck should be taken out for taxes. While filling out a federal tax form can be intimidating, it is not as difficult as it may seem. Here is a breakdown of what each line means so you can fill out your W-4 with ease:

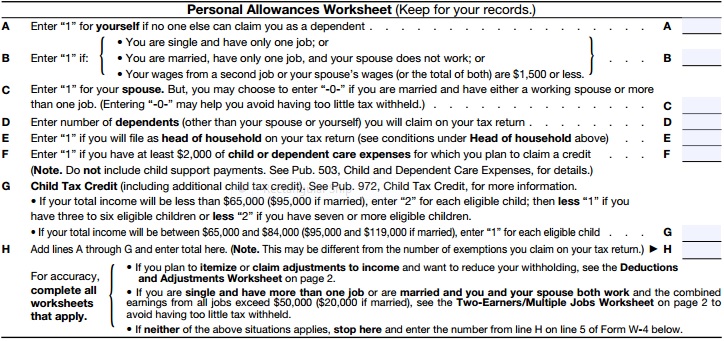

A: Enter “1” for yourself if no one else can claim you as a dependent:

The only reason to not put “1” in this line is if someone else can claim you as a dependent. As a dependent, the person who claims you gets the benefit of your personal exemption and you will owe slightly more in your own taxes.

B: Enter “1” if:

If you are single with one job you have a choice to make on how many allowances you want to claim. A majority of people only claim one allowance but that generally results in getting a tax refund. If you decide to claim two allowances that would probably get you closer to your exact tax liability, but it puts you in danger of possibly owing some money to the IRS. You have the option to take the risk and claim two allowances giving you more money throughout the year and possibly owing some money at tax season or you can claim one allowance and most likely get a refund check back.

C: Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more than one job. (Entering “-0-” may help you avoid having too little tax withheld.)

If you are married mark down a “1” on this line. You do have the option to not mark this allowance if your spouse also works or if you have more than one job.

D: Enter number of dependents (other than your spouse or yourself) you will claim on your tax return:

Enter the number of children or other dependents you will claim on your tax return sheet.

E: Enter “1” if you will file as head of household on your tax return:

Here is the official IRS definition of Head of Household: “Generally, you can claim head

of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s) or other qualifying individuals.”

These dependents may include: brothers, sisters, grandparents, grandchildren, or dependent children. If you do not have a dependent in your house or you are married, you are not eligible for Head of Household status.

F: Enter “1” if you have at least $2,000 of child or dependent care expenses for which you plan to claim a credit:

If you pay $2,000 or more for child care in the year you may be eligible to claim a tax credit. If you are spending that amount or more on childcare put a “1” in this line.

G: Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

The Child Tax Credit can reduce your federal income tax by up to $1,000 per eligible child. For a child to be eligible they must meet the following criteria:

If your income is less than $65,000 before taxes (or $95,000 for married couples) enter “2” for each eligible child in line G. If you have three to six children subtract 1 from the number you placed in line G. If you have seven or more children subtract 2 from the number you placed in line G.

If your income is between $65,000 and $84,000 before taxes ($95,000 and $119,000 for married couples) enter “1” for each eligible child.

H: Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.)

Add up lines A thru G and put them in line H, this is your total number of exemptions you will be filing.

For numbers 1-4 on the withholding allowance certificate fill out your name, social security number, address, and marital status. If your last name is different from what is on your social security card check the box at number 4. For line 5 enter the total number of allowances you have listed on line H from the allowance worksheet.

If you wish to claim exemption from 2014 federal withholdings write “Exempt” on line 7. Claiming to be exempt from withholding means that your employer will not take out any money from your paycheck for taxes. You can only claim exemption of you have no tax income liability in the prior year and you expect to not owe any taxes in 2014. If you are single and under 65 you must make less than $10,000 per year to be eligible for tax exemption. For more information on qualifying for tax exemption read the IRS Publication 501.

Sign and date on line 8 and you are finished with your W-4!

Add comment